Protecting Your Business from Direct Deposit Fraud

Direct deposit fraud is a growing threat to small and midsize businesses, and unfortunately, it’s getting more sophisticated every day. At Candoor, we take payroll security seriously—and your iSolved software includes key safeguards that can help you catch fraudulent changes before they become costly mistakes.

What Direct Deposit Fraud Can Look Like

We’ve seen several fraud tactics in the wild, including:

- Spoofed emails that appear to be from employees, requesting banking changes

- Compromised employee email accounts used to access Employee Self Service (ESS)

- Hacked HR or payroll manager logins making unauthorized changes to multiple employees

What You Can Do

1. Enable ESS Notifications

Any time a direct deposit change is made in isolved, the employee is automatically emailed (as long as ESS is enabled) to notify them of the update. Encourage employees to report any unexpected changes immediately.

2. Always Verify Change Requests

Never rely on an email alone. Always confirm direct deposit changes in person, by phone, or text. Even if it looks like the message is coming from your employee, verify it’s legitimate before making any updates.

3. Use the “New Employee and Change Audit” Report

This essential report logs any updates to employee setup since the last payroll, including:

- Direct deposit changes

- Address or tax modifications

- Benefit or deduction updates

How to Access the Report

There are two places you can find the New Employee and Change Audit report:

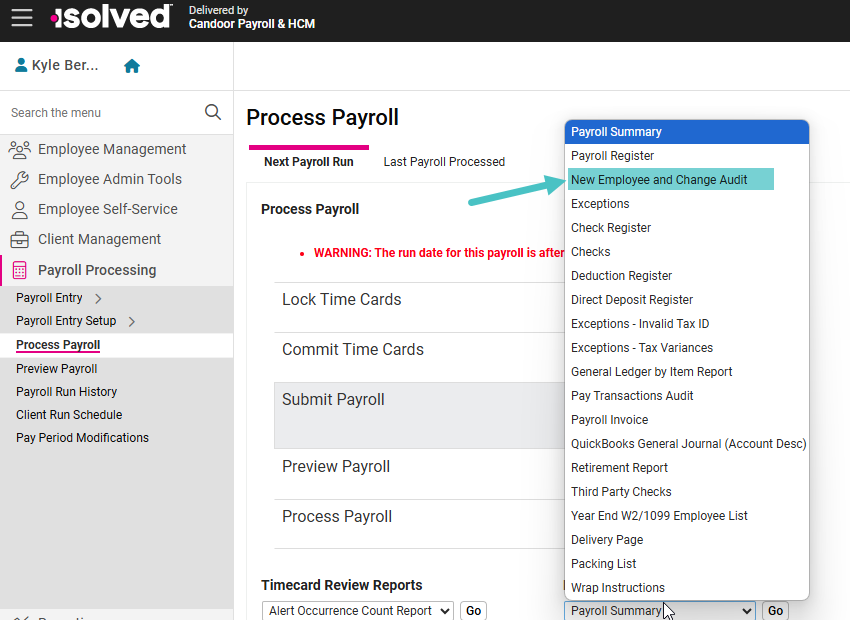

1. While Submitting Payroll (Preview)

- Go to Payroll Processing > Process Payroll

- Click Payroll Preview Reports

- Select New Employee and Change Audit

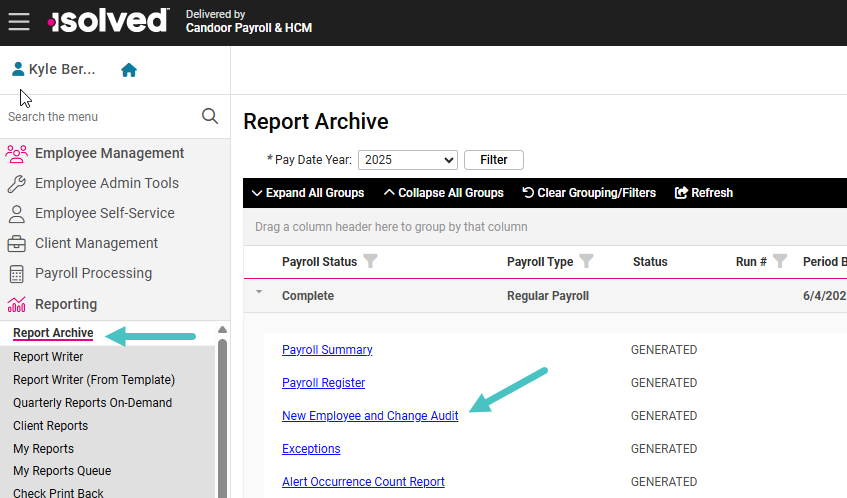

2: After Payroll is Processed (Archived)

- Go to Reporting > Report Archive

- Find the most recent payroll

- Download New Employee and Change Audit

Video Walkthrough

Need help locating and reviewing the report? Watch our quick video guide: